can i cash out my 401k

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Just because you can cash out your 401k doesnt mean you should.

Should I Cash Out My 401k To Pay Off Debt

Ad Easy to Qualify No Monthly Payment.

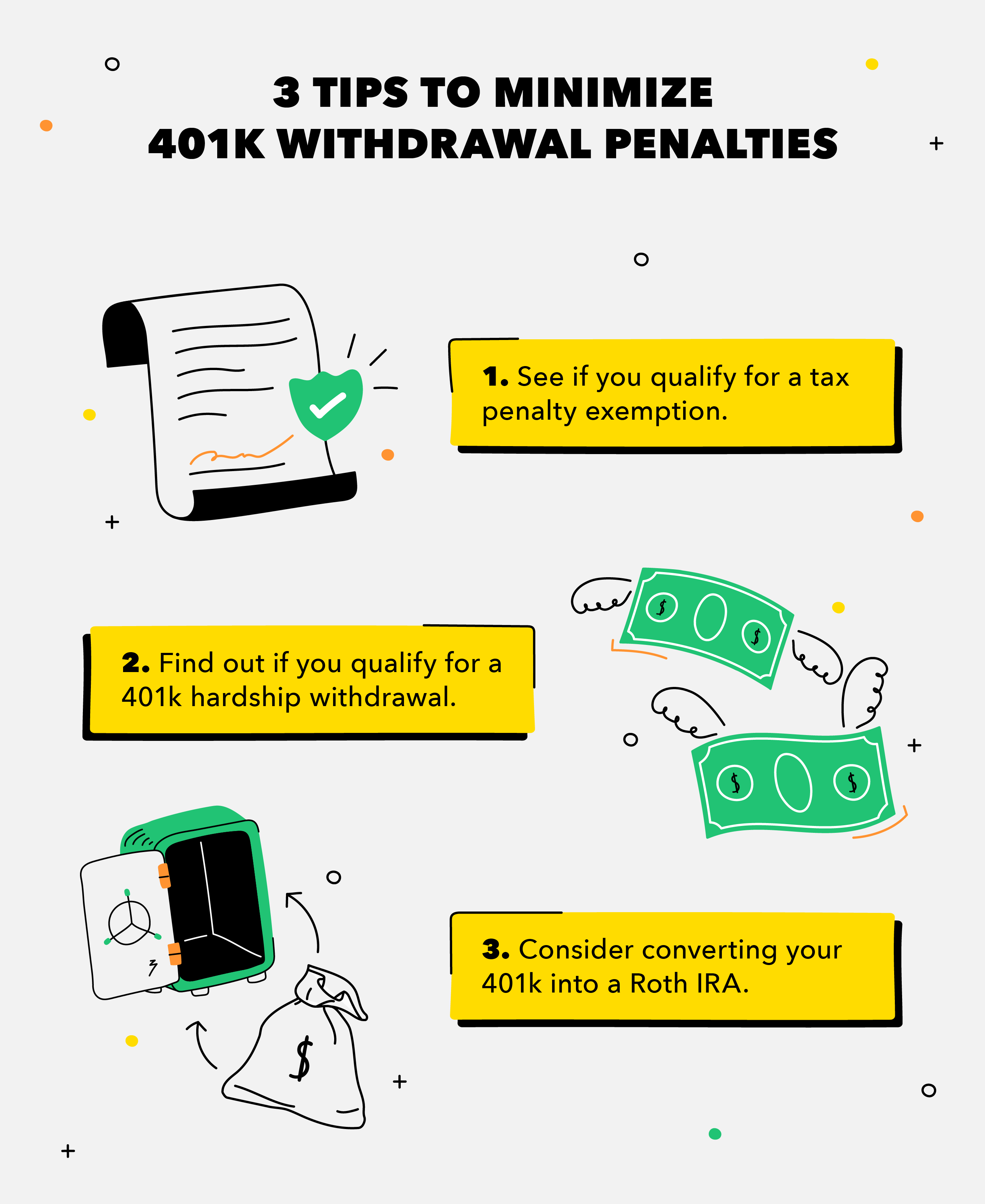

. Ad Easy to Qualify No Monthly Payment. Rolling a 401k into an IRA may also be a way to finagle cashing out a 401k without having to pay the 10. You are allowed to cash out a 401 k while you are employed but you.

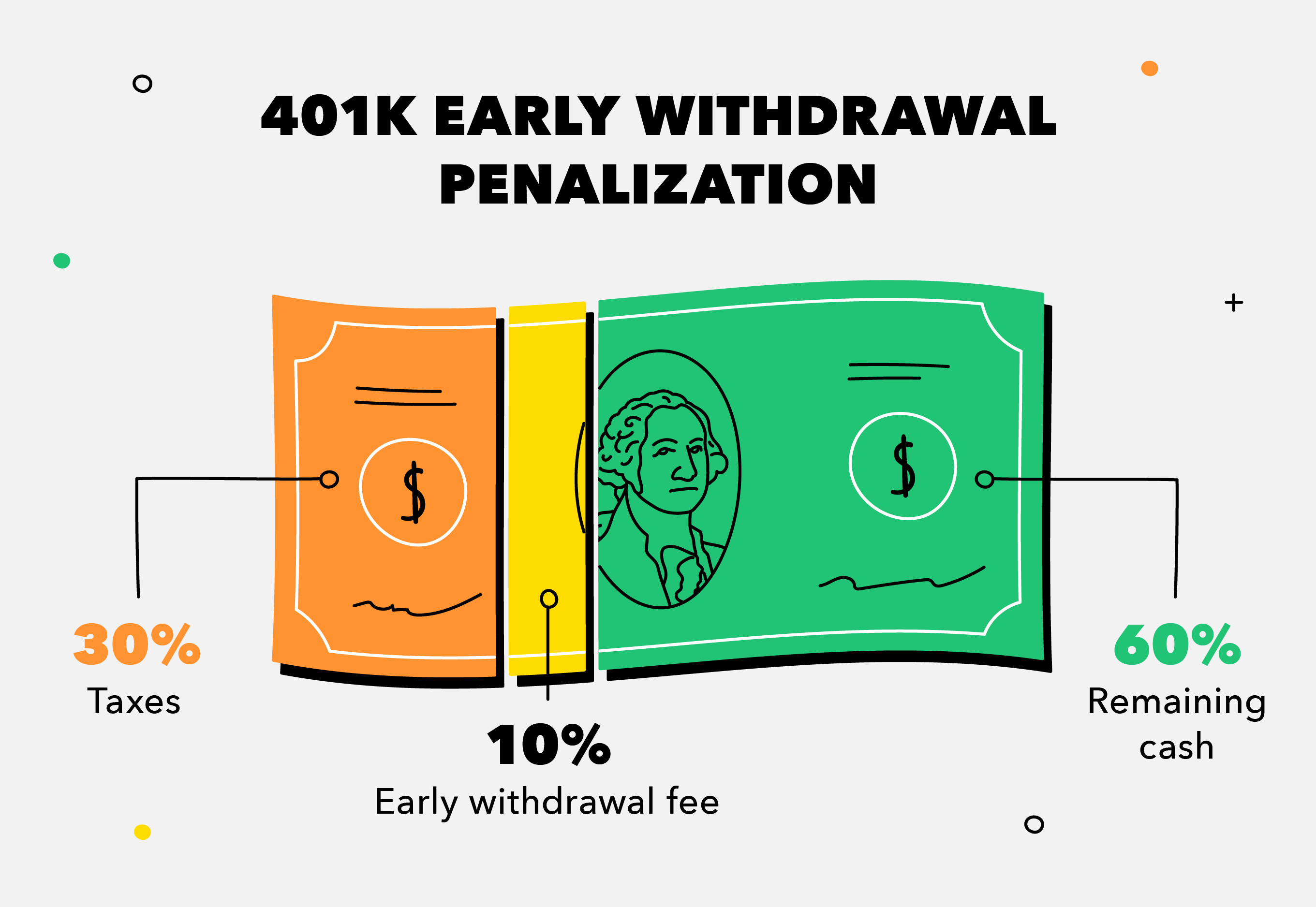

Do Your Investments Align with Your Goals. This guide may be especially helpful for those with over 500K portfolios. If you withdraw money from your 401 k account before the age of 59 12 you must pay a 10 early withdrawal penalty in addition to income tax on distributions.

You Are Penalized By The Irs. Its possible to get money out of the account before age 59 12 if you need to. Find a Dedicated Financial Advisor Now.

After youve left your employer you can ask your plan administrator for a cash withdrawal. If you withdraw money from your 401k before youre 59 ½ the IRS penalizes you with an extra 10 percent on those funds when you file your tax. This guide may be especially helpful for those with over 500K portfolios.

Get in Touch with us and we Will Help You to Create the Right Solution for Your Needs. Ad If you have a 500000 portfolio download your free copy of this guide now. In most cases you contact the plan administrator for the appropriate paper work fill it out send it to the.

Ad If you have a 500000 portfolio download your free copy of this guide now. Find a Dedicated Financial Advisor Now. Get in Touch with us and we Will Help You to Create the Right Solution for Your Needs.

You can cash out a 401k while you are employed but you cannot cash it out if youre still employed at the company that sponsors the 401k that you wish to cash out. C ashing Out a 401 k in the Event of Job Termination You just need to contact the administrator of your plan and fill out certain forms. How do I cash out my 401k after I quit.

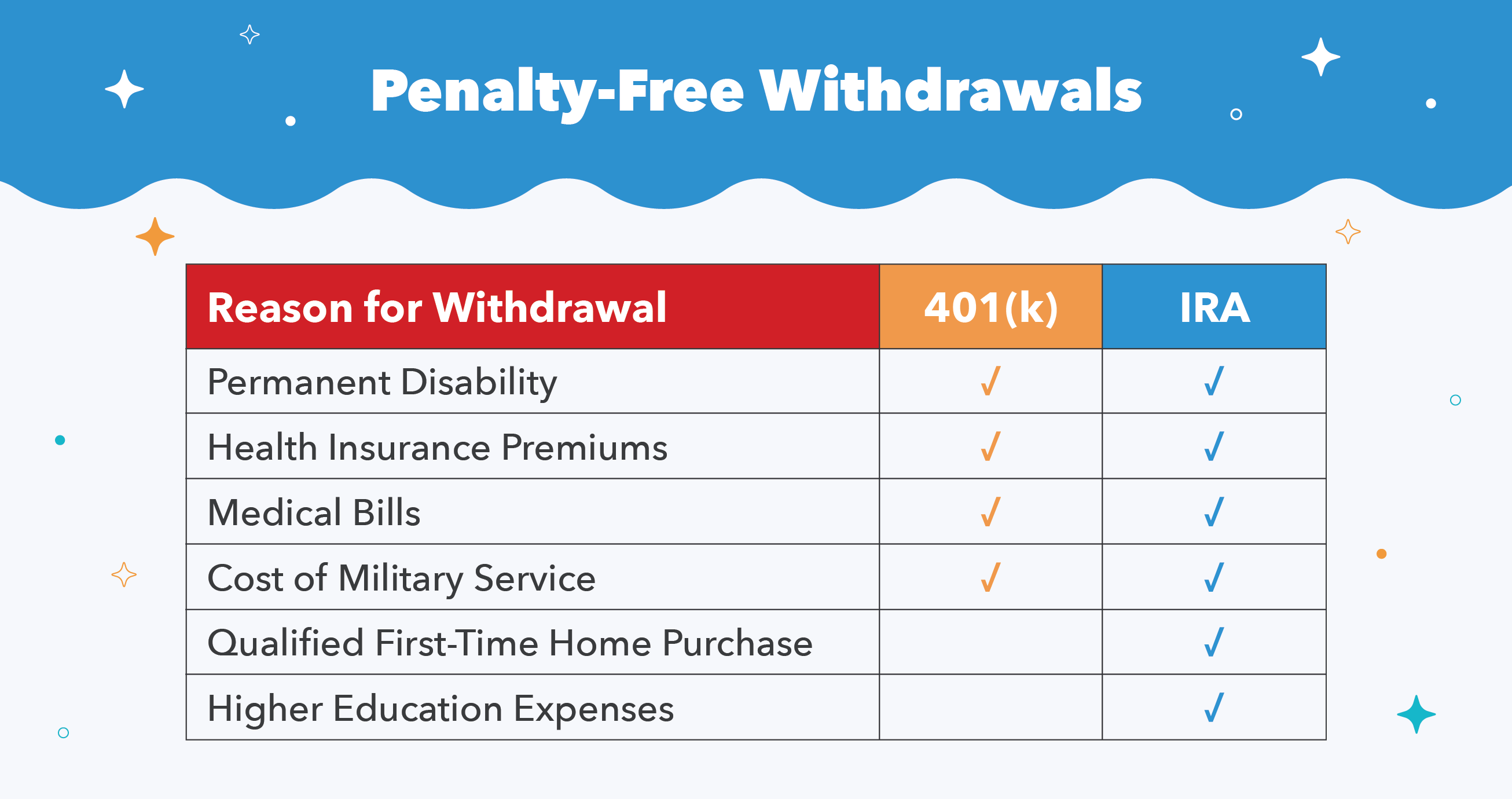

You can take out up to 10000 for a first-time home purchase. Cashing out a 401k from a former employer is not a difficult task. Individuals affected by COVID-19 can withdraw up to 100000 from employee-sponsored retirement accounts like 401 ks and 403 bs as well as personal retirement.

Normally you can not cash out your 401k. Cashing out of your 401k is an incredibly risky choice that should only be made. Do Your Investments Align with Your Goals.

You can roll over a part of a 401k distribution into a qualified retirement account but the rollover is subject to certain restrictions. But with a few exceptions the account holder will be hit with a substantial income tax bill plus a. One of the rules related to cashing out a 401 k relates to the employment status of the account owner.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. If you get terminated from your job you have the ability to cash out the money in your 401k even if you havent reached 59 12 years of age. Unexpected costs can tempt you to put your retirement savings on hold in favor of access to quick cash.

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 K Before I Retire

This Is What Happens To Your 401 K When You Quit Mintlife Blog

Should I Cash Out My 401k To Pay Off Debt

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

0 Response to "can i cash out my 401k"

Post a Comment